Cellular agriculture landscape

Products, locations, and opportunities for the fermentation-tank farmers of the future [visualizations & analysis].

This is the 6th in a series of articles scouting emerging biotechnologies with potential for transformative ecological impact. See the posts on mycomanufacturing, synthetic silk, microbiomics, deep space food systems, and an introduction to the Fifth Industrial thesis.

Cellular agriculture: definition, products, industry landscape, & white space

I’ve analyzed 127 CellAg startups to find what they make, where they are, and what the white spaces are – plus as many other facts as I can squeeze in.

What is cellular agriculture?

Cellular agriculture (“CellAg”) is a term coined by New Harvest in 2015 to describe animal products made without animals, though it seems to lack a unifying definition. Most equate CellAg to cell-cultured meat, but the technology is more of an agricultural paradigm that encompasses several production platforms than a product category.

I define cellular agriculture as: the cultivation of any cells (fungi, bacteria, animal, plant, etc) as a bioproduction platform for agricultural products. CellAg includes cell-cultured (cultivated) animal tissues, precision (microbial) fermentation, and biomass fermentation, but not other related technologies like plant molecular farming, traditional fermentation, or biopharmaceutical production. The US federal definition of agricultural products is “agricultural, horticultural, viticultural, and dairy products, livestock and the products thereof, the products of poultry and bee raising, the edible products of forestry, and any and all products raised or produced on farms and processed or manufactured products thereof.”

Put simply, if it would normally be made on a farm, but we make it in a bioreactor instead, it’s CellAg. It’s like vertical/indoor farming taken to the absolute extreme: instead of taking the plant/animal out of the field, we take the cell out of the plant and put it in a fermentation tank.

Analysis

The field of cellular agriculture is proliferating so rapidly that it is hard to keep up. So, I put together a landscape analysis of startups in CellAg and the products they are making. It’s my best attempt, though I am surely missing players. The list includes only companies creating end products or ingredients through CellAg. It does not include the emerging crop of B2B companies providing tools, inputs, or services like cultured meat scaffolds or bioreactor design. It also doesn’t include processing enzyme producers (e.g. CellAg chymosin that has been used in cheesemaking for years) or collateral applications like biomedical or cosmetics.

Fast facts on the landscape:

CellAg startups globally: 127

Median founding year: 2018 (mean is 2016.75). It’s growing fast, see the chart below.

Amount of investment: over $4.7 billion in the top 20 companies alone. Excludes Impossible & JUST due to focus on plant-based aspects, but includes buyouts (e.g. $830MM for Quorn).

Most well funded CellAg startups: Zymergen ($874MM), Ginkgo Bioworks ($797MM & spinout Motif FoodWorks raising $118MM), Perfect Day ($361MM), Spiber ($356MM), Bolt Threads ($218MM), Memphis Meats ($206MM), Nature’s Fynd ($158MM), Calysta ($129MM), Geltor ($114MM). Quorn sold to Monde Nissin in 2015 for $830MM, and now the joint co is filing for a $1Bn+ IPO [all per Crunchbase].

Most active investors: SOSV (first by far), following by the “vegan mafia” (incl. Unovis/New Crop Capital, Stray Dog Capital, CPT Capital, Agronomics, & Blue Horizon).

NGOs that support: New Harvest, Good Food Institute, CellAgri, Cellular Agriculture Society, Food Frontier, Shojinmeat Project, ProVeg, Cellular Agriculture Canada, Protein.Directory, Cellular Agriculture Australia, Cellular Agriculture UK, Agriculture Cellulaire France, and several university clubs.

Most common product: meat tissue, specifically beef. See next section.

Products

As visualized in Figure 1 (above), CellAg is so much more than just producing animal products without animals (though that is a key use case). In addition to meat/egg/dairy cells and/or proteins, CellAg is already being deployed to create novel protein biomass, leather, leather analogs, lipids like palm oil and dairy fat, cocoa, whiskey, ivory, honey, fur, cotton, and growth factors for tissue engineering.

These bio-similar/bio-identical compounds could be used to recreate the functionality of any agricultural product that we want to displace because current practices are any of the following: economically inefficient, water intensive, land intensive, carbon-emitting, polluting, labor intensive, unpredictable, or inhumane.

Some highlights from the landscape:

Cultivated meat is the #1 most popular product category, followed by biomass (mostly fungal), then textiles (mostly cellulose leather analog), then dairy (mostly bovine proteins).

The most popular product subcategories were beef, then fungi protein, then cellulose leather analog, then silk, then pork, then chicken.

Especially interesting applications include rhino horn (Pembient), fur (Furiod), foie gras (Gourmey, Peace of Meat), horse (ArtMeat), cotton (Galy), whiskey flavors (Endless West), cocoa (California Cultured), and tortoise (Vow).

Geography

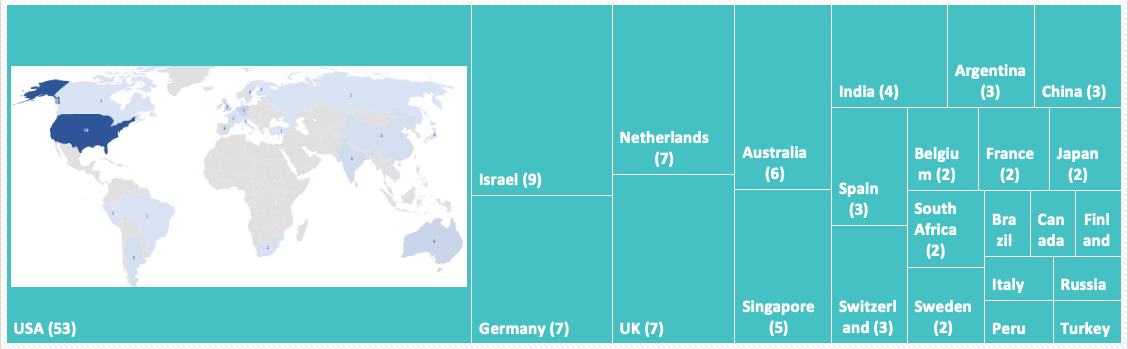

The United States is off to a huge lead. Over 40% of all CellAg startups are based in the US (53 of 127), with 32 companies based in California, 5 in Massachusetts, 5 in New York, and the remainder scattered.

However, hubs have emerged outside of the US in Israel (9), Western Europe (~28), and the Asia Pacific region (~16).

Cellular agriculture can allow for economic development that is decoupled from land use, water use, and carbon emissions of intensive animal agriculture or other unsustainable farming practices. And so, it is a key food security, food sovereignty, and biosecurity initiative of innovative (and small) countries like Israel and Singapore. Singapore, through a series of incentive programs, has attracted several companies to locate R&D or production facilities there as well as being the first country to approve the sale of cultivated meat (chicken from JUST).

White spaces

Ignoring obvious areas like government R&D funding, early stage venture capital funding, production infrastructure, globalization, and horizontal entrants, I think the greatest opportunity of cellular agriculture still lies in vertically integrated companies pursuing product white spaces. As far as I know, few or no CellAg companies are pursuing the following products (though this isn’t an endorsement of these products):

Seafood delicacies like abalone, sea cucumber, shark fin, cuttlefish, squid, octopus, and alligator/crocodile.

Non-meat animal tissues/cells (other than fat or liver cells) like pork intestine, skins, blood, or serum.

Hard-to-produce plant/fungi flavors/compounds like those in truffles, saffron, mahlab, aged wine, or cannabis.

Extinct species (inspired by Geltor’s mastodon gelatin gummies) or most exotic species (inspired by Vow’s approach of cultivating exotics in search of culinary breakthroughs).

Animal textiles like wool, various furs, and exotic skins.

Goods with problematic supply chains or production methods (inspired by c16 Biosciences palm oil).

Bioprospecting the plant, animal, and microbial kingdom for novel functional proteins, lipids, or other molecules. The pharma industry has been successful with biodiversity prospecting.

If you are working on one of these white spaces, please message me on LinkedIn. I’m interested and also now investing in early-stage CellAg/alt protein startups with Blue Horizon.

Final thoughts

We are clearly in the embryonic days of cellular agriculture, and I think its impact could be of the same magnitude as the domestication of animals and plants that gave us the First Agriculture Revolution and therefore permanent settlements and ultimately the Industrial Revolution. The advent of cellular agriculture has been called the “Second Domestication” that could lead to a “death spiral” of industrial animal agriculture (per ReThinkX)

Though it brings up interesting ethical questions – like whether these products vegan, whether they are still inherently exploitative, and how we can be confident that they will be environmentally friendly – the Second Domestication could give us agriculture decoupled from deforestation, a powerful climate change mitigation tool, the end of animal agriculture, and maybe even permanent settlements in space (as I wrote last time).

Thanks for reading! Feedback, subscribing, and sharing is always appreciated. -Nate

I would like to be part of this Mind Blowing Future Idea. This will be the Future of the World in coming years